Examining Cross-Border Gambling Tax Harmonization: Challenges and Opportunities

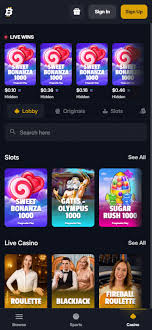

The world of gambling, particularly online gambling, is rapidly expanding. As this industry grows, so does the complexity of the regulations associated with it. One significant issue that has arisen is that of tax harmonization across different jurisdictions. How countries manage taxation in cross-border gambling scenarios has become a focal point for policymakers and the gambling industry alike. Gambling operators like Cross-Border Gambling Tax Harmonization in 2026 Bitfortune casino are navigating a maze of taxes imposed by multiple governments, causing widespread confusion and inefficiencies.

The Current Landscape of Gambling Taxes

Currently, various countries have different approaches to taxing gambling activities. Some jurisdictions impose high taxes on gambling revenues, while others offer more favorable tax rates to attract operators. This inconsistency can create a complicated environment for both operators and consumers, making compliance challenging and increasing the risk of tax avoidance.

Understanding the tax framework in different countries is essential for operators who wish to expand their services internationally. For example, some countries may impose a revenue-based tax, while others may prefer a more traditional profit tax model. Moreover, tax rates can fluctuate significantly, which affects how operators shape their business models.

The Role of Online Gambling

The advent of online gambling has exacerbated the issues surrounding tax harmonization. Unlike traditional gambling establishments, online platforms can operate across borders, leading to regulatory challenges. Consumers often gamble in jurisdictions different from where they reside, which complicates tax collection for governments.

This phenomenon raises questions about the legal responsibilities of operators. Should they be accountable for taxing transactions in the player’s home country, the country of the operator, or both? The answer is not straightforward, and the lack of clarity can lead to significant disparities in taxation, often favoring those operators that can exploit loopholes.

Benefits of Tax Harmonization

One of the primary arguments for cross-border gambling tax harmonization is that it would create a level playing field for operators. By establishing a standard tax rate or framework, countries could help eliminate competitive advantages that some operators gain through beneficial local tax laws. This would not only promote fairness but could also ensure that governments receive their fair share of tax revenue.

Additionally, tax harmonization could ease compliance burdens for operators. Instead of navigating a patchwork of regulations, operators could concentrate their efforts on strategic growth without being bogged down by varying tax regimes. This could potentially attract more investment in the gambling sector, ultimately benefiting consumers through improved services and products.

The Challenges of Achieving Harmonization

Despite the potential benefits, achieving tax harmonization in the gambling sector is fraught with challenges. Each country has its own economic interests and political landscapes, leading to resistance against any changes that may affect national tax revenues. Furthermore, gambling is often seen as a means for governments to generate income, making any push for lower taxes politically contentious.

Another significant hurdle is the international nature of online gambling. Establishing a universal framework requires cooperation among many different nations with varying cultural attitudes toward gambling. Moreover, the rapid pace of technological advancement in gambling products means that tax frameworks may struggle to keep up, necessitating frequent revisions to any harmonized agreements.

Case Studies: Successful Approaches to Tax Harmonization

In recent years, some regions have made strides towards tax harmonization in the gambling industry. The European Union (EU) has seen various member states engage in discussions about creating a standardized regulatory framework for online gambling. These conversations are often centered around ensuring consumer protection, promoting responsible gambling, and, importantly, addressing tax issues.

One notable example is the collaborative efforts made by several EU countries to align more closely on VAT (Value Added Tax) and gambling taxes. By sharing best practices and aligning their tax structures, these countries aim to create an environment conducive to growth while ensuring that governments collect necessary revenue.

Future Outlook

As the online gambling industry continues to evolve, the urgency for a standardized approach to gambling tax will only increase. Consumers are demanding more from their gambling experiences, and regulatory bodies must strike a balance between fostering innovation and ensuring compliance.

In the coming years, we may witness a greater movement towards tax harmonization as nations begin to evaluate the challenges and opportunities presented by a global online gambling market. International organizations may play an increasingly critical role in mediating discussions between countries, especially as digital gambling continues to grow.

Conclusion

Cross-border gambling tax harmonization represents a substantial challenge that requires cooperation and innovation from both governments and the gambling industry. While the road ahead may be fraught with difficulties, the potential benefits of a harmonized tax regime could outweigh these challenges, creating a more robust gambling industry that benefits stakeholders at all levels.